Property Equity Line of Credit score (HELOC) – Among the list of much more desirable options of cash-out refinancing (besides the dollars in hand) could be the minimal fastened fascination amount. That becoming mentioned, in some circumstances a house equity line of credit score may be the higher option (based on your scenario). Although you'll be paying the next desire rate, it may usually be offset from the shorter loan time period.

An FHA cash-out refinance enables you to borrow revenue to transform your residence at nowadays’s very low desire premiums by using the equity built up in your own home.

The political instability, financial instability, wellness scare, and violance have caused an increase in desire for suburban and rural single spouse and children residences though Office environment rents in significant cities fell.

calculator. When you've got an current loan, input your fascination fee, regular monthly payment volume and the quantity of payments are left to calculate the principal That continues to be on the loan. Find the Fascination Fee

When payment and compounding frequencies vary, we first work out the Equal Interest Rate making sure that fascination compounding is similar to payment frequency. We use this equal level to build the loan payment amortization routine.

This features speaking with more than one lender and getting rates from a number of various spots. Automobile sellers, like several firms, want to make just as much income as is possible from a sale, but usually, offered sufficient negotiation, are prepared to provide a car or truck for drastically below the worth they at first give. Getting a preapproval for an automobile loan as a result of direct lending can assist negotiations.

The higher your credit history more info rating and the much less financial debt you already have, the upper your odds are to not just be authorized, but to find the best interest costs in addition. Even if you get the most effective desire fees, the amount of desire you will pay to borrow a loan as huge as $85,000 will still be considerable.

Funds—refers to some other belongings borrowers may have, Besides income, that may be made use of to meet a credit card debt obligation, for instance a deposit, financial savings, or investments

Details are handled being an upfront desire payment. Desire on HELOC and home equity loans is no more tax deductible.

These prices can range from 3% to 6% of the entire loan total, and that may total into a size a sizable sum. Finally, you will have to make a decision Should the charges related to a cash-out refi are worthwhile for the access to All set cash.

At Acorn Finance you can get prequalified for $85,000 without any influence on your credit score. Using a top rated network of lenders, it is possible to obtain several own loan features and Examine all of them in a single place.

Doc Service fees—That is a price collected with the seller for processing documents like title and registration.

A lot of the Federal guidelines such as CARES and HEROES acts not simply doled out generous unemployment Added benefits but in addition prohibited evictions for an absence of hire payments. Some condition and native governments also prohibited evictions for nonpayment of hire.

Homeowners Keeping an FHA backed mortgage may benefit from cash-out refinancing, although the procedures and restrictions are marginally unique from typical refi packages.

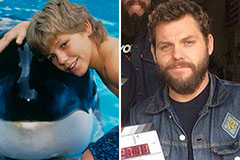

Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Patrick Renna Then & Now!

Patrick Renna Then & Now! Shane West Then & Now!

Shane West Then & Now! Monica Lewinsky Then & Now!

Monica Lewinsky Then & Now! Soleil Moon Frye Then & Now!

Soleil Moon Frye Then & Now!